When Bitcoin launched in January 2009, it was worth pennies.

One man even tried to auction off 10,000 Bitcoin for $50 in 2010 – only to be told that price was way too expensive.

Fast forward to now, and that crypto haul would be worth about $650m (£470m).

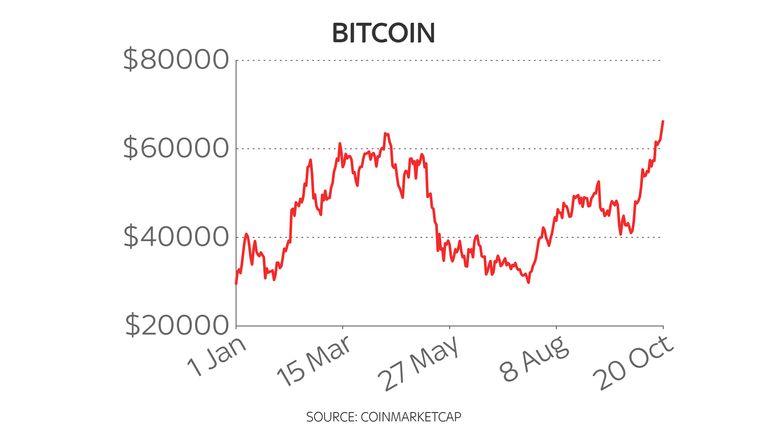

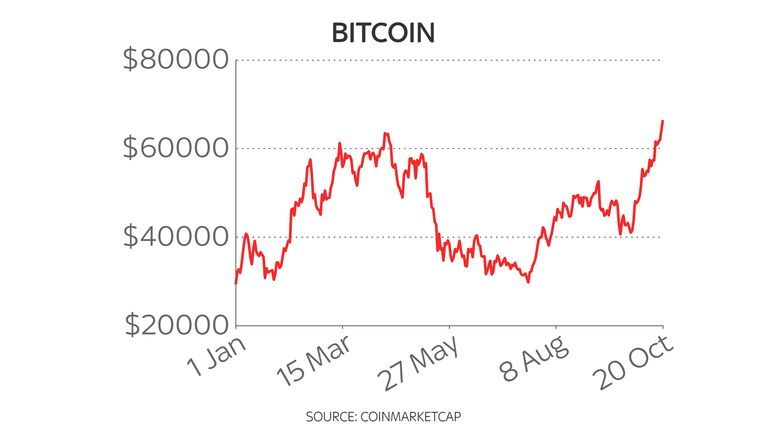

Bitcoin’s latest rise to $67,000 has befuddled billionaires and spooked central banks.

For most of its existence, the cryptocurrency has been described as a bubble that is fit to burst – but so far, each stomach-churning fall has been matched with an equally dizzying recovery.

Although awareness of this digital asset has risen in recent years, it remains little understood.

The Financial Conduct Authority revealed in June that the number of Britons who own cryptocurrencies has surged to 2.3 million – yet at the same time, the number of people who could accurately describe what they are has fallen.

This is a huge worry to regulators. They fear consumers who may not know what they’re doing will end up losing eye-watering sums of money – and indeed, some already have.

Some countries want to ban Bitcoin altogether – India and China among them – but doing this is easier said than done.

The cryptocurrency’s decentralised nature means that the Bitcoin network is spread around the world. There’s no single person who can be pressured to shut it down, and no one computer that can take the whole thing offline.

This has created a years-long headache for regulators, not least because of how Bitcoin is often demanded after ransomware attacks.

And all of this comes before we discuss the cryptocurrency’s impact on the environment. If Bitcoin was a country, it would be the 24th-biggest consumer of energy – ahead of Poland and Egypt, and about to overtake Thailand and Vietnam. To compound the problem, less than half of the energy it uses comes from renewable sources.

At the same time, we’re starting to see how this cryptocurrency could potentially be used in daily life.

Several countries in Latin America are keeping a close eye on El Salvador, which has taken the bold step of embracing Bitcoin as legal tender. The cryptocurrency can now be used as a payment method across the country – including in Starbucks, McDonald’s and Pizza Hut. And given how migrant workers attempting to send money back home to their loved ones currently face high fees when using cash, it’s also hoped that Bitcoin could lower these costs dramatically.

Inevitably, the other question is whether Bitcoin’s price could rise further.

The British financial institution Standard Chartered has predicted that Bitcoin could hit $100,000 (£72,000) in early 2022. A Bloomberg Intelligence analyst also told me that this price is now “the path of least resistance” in the short term.

But increasing regulatory scrutiny and a precarious global economy mean that this is far from guaranteed.

Over its 12 years in existence, a regular pattern of four-year cycles has formed – propelling Bitcoin to record prices before a sharp decline.

In 2013, Bitcoin surged from $100 to then unprecedented highs of $1,150 – only to fall by 73% to lows of $310 in 2014.

Fast forward to 2017, and a similar pattern emerged. Over the course of the year, its price rallied from $800 to $20,000. Come 2018 and it shed 80% of its value, tumbling below $4,000 at one point.

If this pattern repeats itself once again, Bitcoin will plummet in 2022 – decimating the investments of those who attempted to jump on the bandwagon when prices were high.

Subscribe to the Daily podcast on Apple Podcasts, Google Podcasts, Spotify, Spreaker

Twitter is awash with crypto pundits – often anonymous – who confidently declare a single Bitcoin will be worth millions of dollars in the future. Others dangerously suggest that their followers should take out loans to purchase Bitcoin, something that could lead to financial ruin in an unregulated market where consumers have zero protection if things go wrong.

A Bitcoin enthusiast told me he is adamant that it will render traditional currencies obsolete – and this cryptocurrency will be used to buy bread and pay rent one day.

This argument doesn’t make sense given its volatility. Who would spend £1 of Bitcoin on a loaf when it could be worth anywhere between 20p and £5 in a year’s time?

Love it or loathe it, Bitcoin isn’t going anywhere. While this latest surge will be good news for some, it will be very bad news for those who jump in at an inopportune moment – blinded by astronomical gains and celebrity endorsements.

More Stories

5 Reasons Why Everyone Should Look Forward to Save Earth Mission’s Takeoff Event

Save Earth Mission’s Takeoff Event Countdown Starts: Get Ready to Witness History

The Save Earth Mission: A Global Movement Towards a Sustainable Future