A hacker has stolen hundreds of NFTs from dozens of people on the popular trading platform OpenSea, the company’s chief executive has confirmed.

The thefts have prompted a scare in the cryptocurrency community, where many people are attempting to realise enormous gains by investing in largely unregulated assets.

Devin Finzer confirmed on Twitter that the company believed the hacker made $1.7m (£1.25m) from selling the stolen non-fungible tokens (NFTs), but stressed that rumours “this was a $200 million hack are false”.

What happened?

According to the blockchain analysis company PeckShield, at least 254 tokens were stolen as a result of an unknown attack.

Some of the tokens have been returned, Mr Finzer said.

It is believed that the hacker tricked their victims into signing partial digital contracts sanctioning the trades using a phishing email, before then completing the contract to transfer their victims’ tokens to an address which they controlled.

Read more: Why are some digital artworks selling for millions?

On Sunday, Mr Finzer said that OpenSea believed the attack had only taken place on Saturday. But he warned that the company didn’t yet know how users had been tricked into signing the trades.

OpenSea’s chief technical officer Nadav Hollander added that 32 users having NFTs stolen over “a relatively short time period… suggests a targeted attack as opposed to a systemic issue.”

What is an NFT?

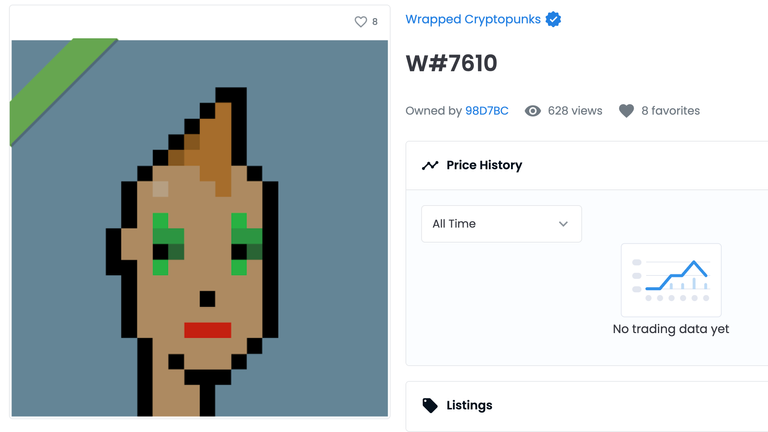

NFTs – which have surged in popularity over the last year – are a token of ownership attached to a blockchain.

They are essentially certificates similar to cryptocurrency coins and stored on the same blockchain ledgers.

However, whereas those coins are fungible – because they can be broken down into smaller units, for example 0.001 of a coin – an NFT certificate is non-fungible, because parts of it cannot be exchanged for anything else.

Some of the most sought-after, which some in the tech community liken to works of art, sell for tens of millions of dollars.

Their proponents claim they are a unique asset class while critics say the tokens are fundamentally valueless.

OpenSea, which brands itself as the world’s largest NFT marketplace, offers its users an interface to purchase and sell NFTs.

Last year, payments company Visa paid $150,000 (£110,000) for a ‘CryptoPunk’ NFT as part of what the company called “a new chapter for digital commerce”.

A recent report found that more than $44bn (£32bn) worth of cryptocurrency was sent to NFT-related smart contracts last year, up from just $106m (£78m) in 2020.

The report warned that fraudsters were making millions by artificially inflating the value of their tokens through a process known as wash trading.

More Stories

5 Reasons Why Everyone Should Look Forward to Save Earth Mission’s Takeoff Event

Save Earth Mission’s Takeoff Event Countdown Starts: Get Ready to Witness History

The Save Earth Mission: A Global Movement Towards a Sustainable Future