Peloton, the connected exercise bike and treadmill provider, has announced plans to drastically cut costs including 2,800 job losses – with even its chief executive being told to get on his bike following a plunge in performance.

Shares surged by more than 30% as the firm – which enjoyed soaring demand for its subscription products during COVID crisis lockdowns – said it was cutting a fifth of its corporate staff as part of the restructuring, though its teams of screen instructors would be spared.

The move, which also involves a further round of production cuts as part of efforts to save $800m annually, is a response to a dramatic fall in sales since gyms reopened, tougher competition and bad PR following the death of a child.

Peloton had been facing intense investor pressure to overhaul its board and strategy – building on price and production cuts announced late last year.

Peloton said its CEO, co-founder John Foley, would be succeeded by Barry McCarthy – a former chief financial officer of Spotify and Netflix, with Mr Foley assuming the role of executive chair instead.

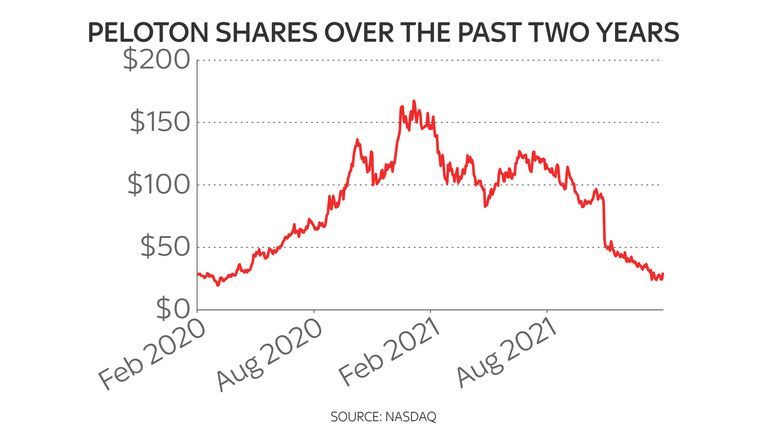

He had become a particular target of activist investor anger over a plunge in market value below $10bn.

Peloton had been worth $50bn a year ago.

The collapse in its shares was reported last week to have prompted takeover scrutiny from Amazon and Nike amid growing calls for Peloton to put itself up for sale.

Investment firm Blackwells Capital accused Mr Foley of presiding over “gross mismanagement” and lacking credibility.

He told shareholders on Tuesday: “Peloton is at an important juncture, and we are taking decisive steps.

“Our focus is on building on the already amazing Peloton member experience, while optimising our organisation to deliver profitable growth.

“With today’s announcements, we are taking action to ensure Peloton capitalises on the large, long-term connected fitness opportunity.

“This restructuring program is the result of diligent planning to address key areas of the business and realign our operations so that we can execute against our growth opportunity with efficiency and discipline.”

Read more about Peloton:

Another TV character falls victim to the exercise bike, but defiantly says ‘I’m not going out like Mr Big’

Peloton speaks out on shock Sex And The City character’s death while riding its bike

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said of the changes: “The demands of activist investors calling for a radical shake up of Peloton appear to have been met, with the chief executive set to step off what has become an increasingly difficult treadmill.

“Clearly Peloton has had a tough time as pandemic darlings have been left behind by re-opening plays over taking in terms of popularity among investors, and this move is set to cause further upset at a volatile moment in the share price.

“However, Peloton has one foot already firmly in the much trumpeted metaverse, with its die-hard fans still deeply hooked to virtual sessions.

“That’s why the company is considered to be so attractive to big hitters like Nike and Amazon. If it can shape up and get back on a recovery trajectory in terms of sales, there may well be more potential suitors eager to jump into the alternative reality of fitness.”

Peloton’s shares had already received a big boost at the start of the week on the reports of takeover interest and were boosted further after the shake-up was announced.

After rising by as much as 33% in Tuesday trading, they ended the session 25% up on the day.

More Stories

5 Reasons Why Everyone Should Look Forward to Save Earth Mission’s Takeoff Event

Save Earth Mission’s Takeoff Event Countdown Starts: Get Ready to Witness History

The Save Earth Mission: A Global Movement Towards a Sustainable Future