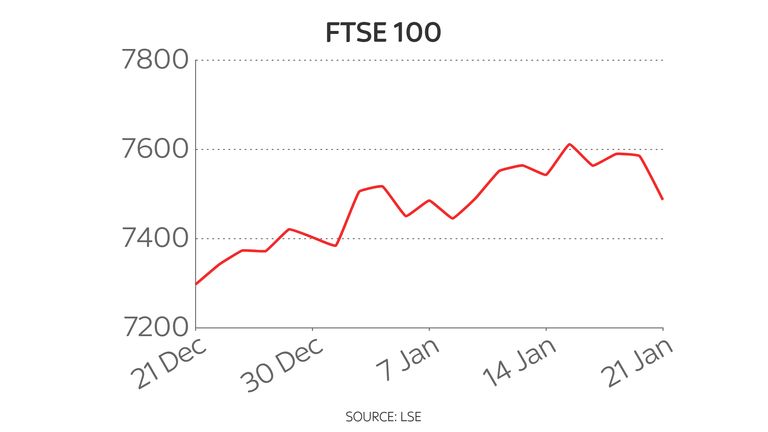

The FTSE 100 has joined a global markets sell-off as it followed Wall Street into the red amid jitters over rate rises and the outlook for tech stocks.

London’s leading share index fell by more than 100 points, or about 1.5%, while Germany’s Dax and France’s Cac 40 were each down by around 2%. The FTSE 100 later partly recovered to close 91 points, or 1.2%, down.

It comes after days of selling pressure in New York as investors digest the outlook for growth stocks at the start of a year when US interest rates look set for a series of hikes.

Those fears have pummelled Wall Street during the opening weeks of 2022.

Higher borrowing costs, pushing up the yields on government bonds, make it relatively less attractive to bet on businesses that look like great growth prospects but might not deliver healthy returns for a few years.

That sentiment has left the tech-heavy Nasdaq index in so-called correction territory, more than 10% off its previous peak, while the broader S&P 500 is down by around 6% since the start of the year.

It has also dragged on appetite for a wider range of risky assets such as Bitcoin, which has dipped below $40,000.

The mood has further darkened on the feeling that some of the stay-at-home stocks that did well during the pandemic face a tougher future as the world emerges from under the shadow of COVID-19.

Most notably, disappointing subscriber numbers from streaming service Netflix and a “resetting” of production levels by exercise bike maker Peloton – though it denied that it was temporarily halting production – have caught the attention.

Wall Street indices had another wobbly start on Friday before stabilising.

The rough start to the year has not been felt so far in London markets, with the FTSE 100 ahead until now in 2022, but it finally took its toll as the week drew to a close.

Among the main fallers were Ladbrokes and Coral owner Entain – which earlier this week revealed a bounce-back for its betting shop business in recent months but saw a fall in online revenues that had been boosted by lockdowns.

Also in the red was Scottish Mortgage Investment Trust, a fund with major investments in tech stocks whose fortunes are consequently linked to that sector.

More Stories

Unlock Your Journey to Intelligent Wealth Management

Inspiring Change: Michael Bates Path to Entrepreneurship and Giving Back

Climate Token YES WORLD is now available for trading on top crypto change LaToken