Markets around the world have been rattled by fears that a Russian invasion of Ukraine could be imminent, dealing a further blow to investors already nervous about rising inflation.

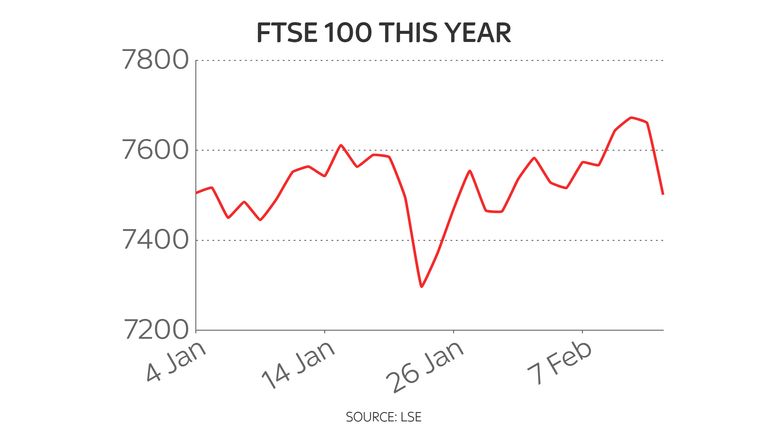

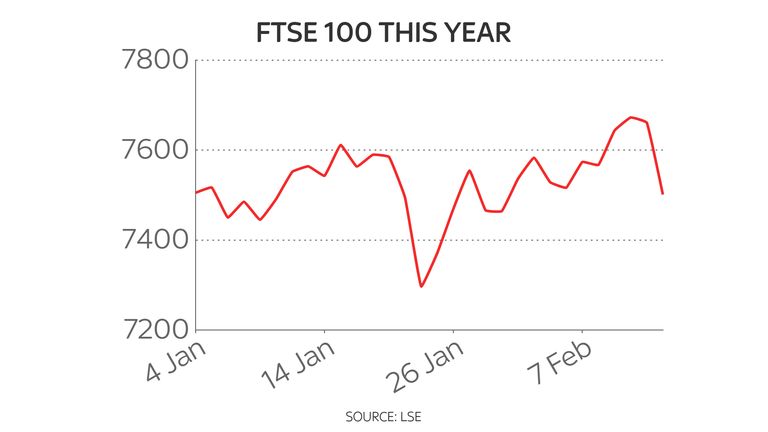

European indexes, including the UK’s FTSE 100, Germany’s Dax and France’s CAC 40, all fell several percentage points at the open – with the US markets later joining them in negative territory.

Companies with exposure to eastern Europe, travel firms, and banks were among those hardest hit.

IAG, the parent firm of British Airways, fell more than 6% in London at one point amid jitters over the prospect of conflict in Europe and what that could mean for airspace after KLM suspended flights to Ukraine as a precaution.

Britain’s armed forces minister told Sky News he was worried an invasion of Ukraine could happen soon.

“My fear is it is very imminent, that’s not to say it’s definitely going to happen,” said James Heappey.

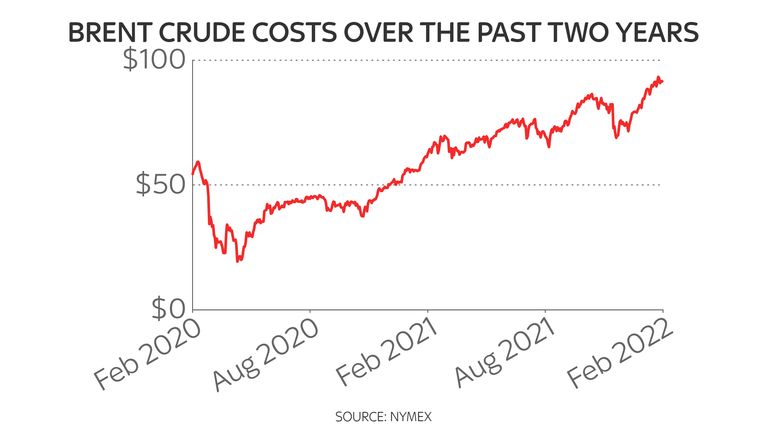

Brent crude oil prices hit their highest level in more than seven years over concerns that a conflict involving Russia could disrupt fuel supplies from one of the world’s top producers.

The move upwards risks further hikes to fuel costs, which were revealed on Monday to have hit new heights in the UK over the weekend.

Natural gas costs were also on the move, with contracts for March delivery up by more than 4%.

Higher energy prices globally have already been a core reason behind the surge in UK inflation to a 30-year high.

Brent crude, the European oil benchmark, hit $96.16 on Monday, its highest level since October 2014, after rising steadily for several consecutive weeks.

If Russia does invade Ukraine, “Brent crude won’t have any trouble rallying above the $100 level”, according to OANDA analyst Edward Moya.

“Oil prices will remain extremely volatile and sensitive to incremental updates regarding the Ukraine situation,” he added.

Investors sought safety in government bonds, gold and the dollar instead.

UK two-year gilt yields, for example, were at their highest level since 2011.

The FTSE 100, Britain’s leading share index, closed 1.7% down. Bank stocks were among the main losers with Barclays, NatWest and Lloyds all down by more than 4%.

The equivalent indexes in France and Germany – which dropped by more than 3% earlier in the day – closed more than 2% lower.

Danni Hewson, financial analyst at AJ Bell, said of the market close: “No one would be surprised to find travel stocks amongst the hardest hit and Wizz Air, Carnival, IAG and TUI all sustained losses.

“Today has been one of those days when fear tumbles into volatility helped by some investors rushing to take profits just in case today’s fall is just the first step down but ready to back buy bargains if the price is right tomorrow.

“The big issue for consumers will be the question mark over those rising energy prices. How high can they go; how much extra pain can be inflicted at a time many people are already struggling with rising costs?”

More Stories

Unlock Your Journey to Intelligent Wealth Management

Inspiring Change: Michael Bates Path to Entrepreneurship and Giving Back

Climate Token YES WORLD is now available for trading on top crypto change LaToken