Confirmation of Plan B COVID-19 restrictions for England has stirred dismay in the leisure, retail and travel sectors – with business leaders warning taxpayer support will be necessary to help firms navigate the impact.

The hospitality sector warned of “catastrophic” consequences without renewed aid from the chancellor, while the CBI and British Chambers of Commerce also raised the stakes on the issue.

Baroness Ruby McGregor-Smith, the BCC’s president, expressed exasperation when she said: “We have been calling on the UK government for several months to set out what contingency plans for business would look like if further restrictions were needed this winter.

“Yet again, firms are now being asked to make changes at the very last minute. Restrictions will also impact on consumer behaviour with knock-on effects which could risk the fragile recovery, order books and revenues.”

The Night Time Industries Association (NTIA) said the Plan B restrictions, including vaccine passports for large events and work from home guidance, would have a “devastating impact” on demand.

Chief executive Michael Kill also questioned the “timing and rationale” for the announcement as the prime minister faces a furore over a Downing Street party last Christmas.

“Nightclubs and bars must not be thrown under the bus for the prime minister to save his own skin,” Mr Kill said.

Under the restrictions, face masks must be worn in most indoor venues, including theatres and cinemas, from Friday – with exceptions including when eating, drinking, exercising or singing.

Mandatory vaccine passports are being brought back in a week’s time for larger events and nightclubs, where people must prove they are at least double-jabbed.

Other business leaders said retailers would suffer in particular under the new advice to work from home from the start of next week – hitting them at their most important time of year – as town and city centres risked a return to “ghost town” conditions.

There was particular relief that there would be no return to the so-called “pingdemic” when close contacts of COVID suffers were told to isolate for 10 days – sometimes decimating workforces and key services including food delivery.

The government is prioritising daily testing for close contacts instead.

Bars and restaurants will be exempt from the new face mask rules.

But Emma McClarkin, chief executive of the British Beer & Pub Association, said of the reprieve: “Make no mistake, this (Plan B) is a huge blow for our sector as it further undermines consumer confidence and is devastating for pubs based near offices and in town centres.”

Kate Nicholls, who heads UKHospitality, demanded “full business rates relief, grants, rent protection and extended VAT reductions” for her membership.

She added: “Anything less would prove catastrophic”.

How financial markets have reacted

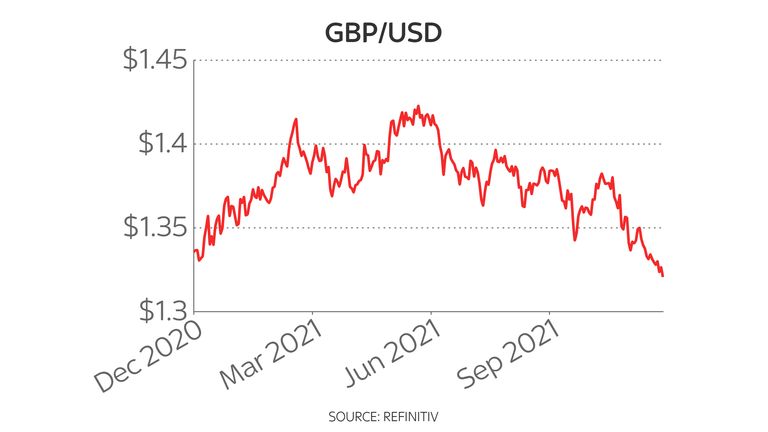

Sterling dropped below $1.32 against the US dollar, to its lowest level since December last year, when reports of tighter curbs first emerged on Thursday morning.

The pound’s weakening reflects the likelihood that further restrictions will hold back the wider economy, dampening already diminishing prospects of a pre-Christmas interest rate hike.

However, sterling was trading flat versus the greenback after the Downing Street news conference – suggesting some relief that the measures did not amount to anything close to a lockdown.

UK stock markets, which closed before the PM’s announcement, had earlier seen travel and leisure shares come under pressure – disrupting their recovery from an initial Omicron shock sell-off.

British Airways owner International Airlines Group – already badly hit after the government imposed travel restrictions in response to Omicron – was among the FTSE 100’s biggest fallers earlier in the day as it slid more than 3%.

The shares ended the day in positive territory.

Aero engine maker Rolls-Royce lost 2% of its value while easyJet, which had dipped by nearly 4%, was just 0.7% down by the market close.

The FTSE 100 ended the day flat.

In the wider leisure sector, hopes of a pick-up for cinemas, restaurants and pubs were punctured by the prospect of Plan B.

Cineworld’s shares fell 5% but later clawed back half that loss.

More Stories

Inspiring Change: Michael Bates Path to Entrepreneurship and Giving Back

Climate Token YES WORLD is now available for trading on top crypto change LaToken

An Exclusive Interview with the Young & Dynamic Entrepreneur, Roberto.