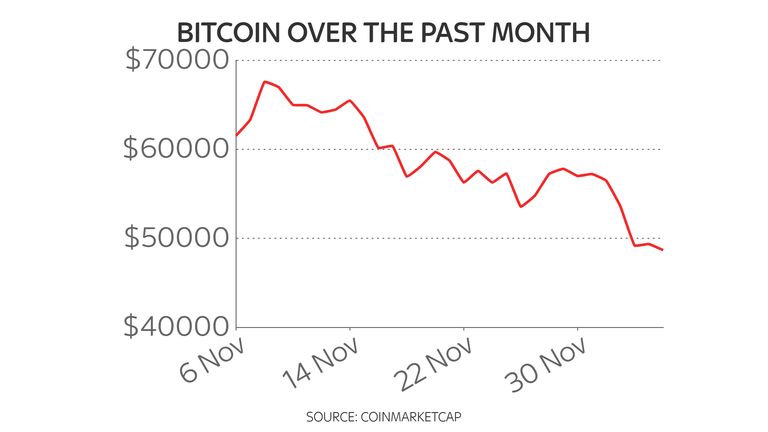

A so-called “flash crash” for Bitcoin over the weekend has wiped out positions worth $2bn and left market experts pondering whether a wider reset for value has set in.

The world’s largest cryptocurrency lost over a fifth of its value at one stage, taking the market capitalisation back below $1trn, after a broader flight from riskier assets kicked in on Friday.

Then, stock markets on Wall Street were among those hit in the wake of a weaker-than-expected report on the US labour market.

Experts also cited traditionally low trading volumes for crypto assets over weekends – a scenario that can exacerbate downward or positive value movements.

They said the weekend rout in Bitcoin‘s price and the amount invested in Bitcoin futures returned to levels last seen in October, just before a massive price surge that sent the token to an all-time high of $69,000.

The digital currency – which is no stranger to wild fluctuations in value – also started Monday on the back foot and was trading around the $47,000 mark on most exchanges.

Matt Dibb, from Singapore-based crypto fund distributor Stackfunds, said: “Our expectation is the rest of Q4 will be a hard month; we aren’t seeing the strength in bitcoin that we generally see after one of these crushing days.

“Leverage markets have been completely reset, and open interest within leverage markets has completely reset.”

Coinglass, the cryptocurrency futures trading and information platform, said that as prices fell on Saturday, investors who had bought bitcoin on margin saw exchanges close their positions, causing a cascade of selling.

A range of retail-focused exchanges closed more than $2bn of long bitcoin positions.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said of the plunge: “The cryptocurrency is highly sensitive to the fortunes of the stock market and traders were spooked by a stock sell off in the US, following some disappointing jobs figures.

“The sharp fall erased the last two months of gains, yet more evidence of the highly volatile nature of the asset.

“Crypto coins and tokens have been propelled higher in this era of ultra-cheap money and as speculation swirls about just when central banks will start further tightening mass bond buying programmes and start raising interest rates, they are likely to continue to be highly volatile.”

More Stories

Unlock Your Journey to Intelligent Wealth Management

Inspiring Change: Michael Bates Path to Entrepreneurship and Giving Back

Climate Token YES WORLD is now available for trading on top crypto change LaToken